CAUSE NO. CL-24-3777-I

| RICARDO CAMPOSPlaintiff, Vs.SURECHOICE UNDERWRITERS RECIPROCAL EXCHANGEDefendant. | §§§§§§§§ | IN THE COUNTY COURTAT LAW NO. 9 HIDALGO COUNTY, TEXAS |

ORDER GRANTING PLAINTIFF’S SECOND MOTION FOR SANCTIONS IN PART, AND DENYING IN PART WITHOUT PREJUDICE

On this day, the Court considered Plaintiff’s Secon Motion for Sanctions.

- On January 22, 2025, the Court heard Plaintiff’s Second Motion for Sanctions in conjunction with other Motions pending before this Court for which Defendant was provided notice on December 16, 2024. Notice was confirmed to have been delivered to Counsel of Record.

- On January 22, 2025, the Court called this matter for hearing. Counsel for Plaintiff, Jason Palker and Raul De La Garza were present. No counsel was present for Defendant when this matter was called, and no Defense Counsel had checked in with the Court’s staff.

- Plaintiff’s counsel Jason Palker announced ready to proceed on the Motion, but urged that this matter be preserved for the end of the Court’s docket, to allow additional time for Defendant’s counsel to appear. The Court, upon Plaintiff’s Counsel’s urging, and on its own volition in the interest of justice, preserved this matter for the end of this Court’s docket.

- Upon reaching the end of the docket, Counsel for Defendant still had not appeared.

The Court and Court’s staff confirmed that no phone calls had been received regarding Defendant’s counsel’s failure to appear. The Court and Court’s staff also confirmed that nothing had been filed with the Court in advance of the hearing providing any basis for Defendant’s Counsel’s failure to appear.

- Upon providing ample time for Defendant’s counsel to appear or otherwise contact the Court, this Court recalled this matter for hearing.

- Upon careful consideration of all briefing before this Court (including all past and instant Motions, Responses, and Replies), all evidence offered and admitted at the instant hearing and past hearing on December 4, 2024, upon hearing argument of counsel on both December 4, 2024 and January 22, 2025, the Court finds that Plaintiff’s Second Motion for Sanctions should be GRANTED in part, and otherwise DENIED WITHOUT PREJUDICE.

- In reaching this determination, the Court considered voluminous briefing submitted by Plaintiff in response to several motions presented by Defendant and its Counsel, Monson Law Firm. The Court also considered all past briefing and argument in reaching this determination. This Court’s findings generally track the chronology of sanctionable conduct occurring throughout this litigation to date. To wit:

- On November 4, 2024, Defendant, by and through its counsel Monson Law Firm, filed its Original Answer, including three motions (1.) for Protection from Discovery, (2.) for Abatement of this Litigation, and (3.) to Preclude Attorney’s Fees. In this filing, Defendant, by and through Monson Law Firm:

A.1.) Made the following FALSE Statements of Fact, presented for IMPROPER PURPOSES

(to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3), & (4)):

- Para. 8: “By its Verified Denial, SureChoice avers that Plaintiff, for this weather- related claim within the purview of §§ 541.154 and 542A of the TEX. INS. CODE, did not comply with the mandatory notice provisions of §§ 541.154 and 542A.003. [Fn. 7 – Affidavit of Michael Cortez].”

- Fn. 7: “See, [Affidavit of Michael Cortez] to Defendant’s Original Answer, affidavit in support of verified denial of notice, pursuant to TEX. R. CIV. P. 93.”

- Para. 10: “Further, by its Verified Denial, Defendant denies that legal and contractual conditions precedent are met. [Fn. 8 – Affidavit of Michael Cortez].”

- Para. 22: “Regarding abatement mandated by law, Plaintiff failed to send a demand notice prior to filing suit.”

A.2.) Made the following FRIVOLOUS Legal Arguments for IMPROPER PURPOSES (to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3)):

- Para. 19: “Defendant seeks protection from all written discovery.”

- Para 21: “This litigation should be, as more fully detailed below, abated pending the latter of proper notice and the completion of the appraisal.”

- Para. 22: “Regarding abatement mandated by law, Plaintiff failed to send a demand notice prior to filing suit.”

- Para. 23: “Defendant SureChoice is entitled to mandated abatement, per Tex. Ins.

Code, §§ 542A.005(b)(1) and (c)(1). [Fn. Citing Michael Cortez Affidavit.]”

- Para. 27: “Plaintiff did not provide timely written notice before filing this lawsuit, as Plaintiff never sent any requisite notice under Chapter 542A (or Chapter 541 and the DTPA or CORC 38) … Therefore, pursuant to §542A.007, “the court may not award to the claimant any attorney’s fees incurred after the date the defendant filed the pleading with the court.””

The Court specifically finds that these statements were demonstrably false, as supported by the record through briefing, argument, and evidence. The Court finds that Plaintiff’s pre-suit demand letter contained an 8-page narrative, and attached an expert report that provided reasonable notice to Defendant of the claims which have since been alleged in this litigation. Moreover, Defendant acknowledged receipt of this notice pre-litigation and refused to pay it, but instead retained an engineer and fully denied coverage for Plaintiff’s claim, despite previously accepting a covered loss had occurred.

Likewise, after opting to fully reject coverage it had previously accepted, Defendant rejected an invitation to discuss the underlying property damage claim dispute pre-litigation with objective awareness that the instant lawsuit would be filed. Defendant likewise did not invoke appraisal pre-litigation, but allowed months to pass without ever seeking additional information from Plaintiff or his counsel. This pre-suit notice letter clearly and unequivocally provided proper pre-suit notice to Defendant.

This Court also finds that Defendant’s footnote seven and eight references are inconsequential. This Court finds that Defendant sought to statutorily abate this matter in bad faith vis-à-vis the attachment of a false affidavit authored by its counsel, Michael G. Cortez. (e.g. “By its Verified Denial, SureChoice avers that Plaintiff… did not comply with the mandatory notice provisions…”). (emphasis added).

The affidavit of Michael G. Cortez offers no testimony whatsoever regarding a lack of sufficient pre-suit notice. This Court finds that this affidavit is not sufficient to abate litigation under Tex. Ins. Code § 542A.005(c)(1), inasmuch as the verification itself does not allege that pre- suit notice was defective and offers no specific testimony to verify any specific portions of Defendant’s Pleas or Motions.

Instead, Cortez’s affidavit claims that Plaintiff failed to cooperate in Defendant’s investigation of the claim. Cortez also claims that Plaintiff failed to provide information regarding claims made with prior insurers.

Cortez, at two separate hearings, and in all briefing before this Court failed to offer any evidence whatsoever regarding Plaintiff’s purported failure to cooperate with an investigation of

the claim. Likewise, Cortez did substantiate Plaintiff’s purported failure to provide prior claim documentation. Indeed, Cortez did not offer any evidence that Defendant even made a request for prior claim documentation. This Court therefore finds that Cortez’s affidavit is false, and was executed under penalty of perjury. This Court specifically finds that for abatement under Tex. Ins. Code § 542A.005, this affidavit was wholly insufficient to warrant automatic abatement.

Tex. Civ. Prac. & Rem. Code § 10.001 Provides:

“The signing of a pleading or motion as required by the Texas Rules of Civil Procedure constitutes a certificate by the signatory that to the signatory’s best knowledge, information, and belief, formed after reasonable inquiry:

- the pleading or motion is not being presented for any improper purpose, including to harass or to cause unnecessary delay or needless increase in the cost of litigation;

- each claim, defense, or other legal contention in the pleading or motion is warranted by existing law or by a nonfrivolous argument for the extension, modification, or reversal of existing law or the establishment of new law;

- each allegation or other factual contention in the pleading or motion has evidentiary support or, for a specifically identified allegation or factual contention, is likely to have evidentiary support after a reasonable opportunity for further investigation or discovery; and

- each denial in the pleading or motion of a factual contention is warranted on the evidence or, for a specifically identified denial, is reasonably based on a lack of information or belief.”

This Court finds that Defendant’s November 4, 2024 filing was presented for improper purposes. At its core, the answer sought to cause unnecessary delay in this litigation via abatement. Moreover, the filing – which this Court has verified is systematically used by Defendant and its counsel, infra. – was intended to harass Plaintiff and needlessly increase the cost of litigation. The past three months of litigation has been devoted to voluminous briefing caused by Defendant’s and its counsel’s decision to submit this patently false and frivolous filing to this Court. All of this briefing has occurred while Defendant has sought to preclude Plaintiff from recovery of any attorney’s fees based on a false claim that Plaintiff’s pre-suit notice was insufficient.

On December 5, 2024, this Court sanctioned Defendant and its Counsel for violations of

T.C.P.R.C. 10.001(1), (2), (3), and (4.). The Court also notes this sanction would be appropriately assessed under T.R.C.P. Rule 13, as Defendant’s motions were groundless and brought in bad faith. A total amount of $3,000.00 in monetary sanctions was ordered to be paid by Defendant to Plaintiff. This Court finds that to this date, this lesser sanction remains unpaid.

- On November 18, 2024, Defendant, by and through its counsel Monson Law Firm, filed its Response to Plaintiff’s Motion to Compel Mediation. In this Response, Defendant, by and through Monson Law Firm:

B.1.) Made the following FALSE Statements of Fact, presented for IMPROPER PURPOSES

(to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3), & (4)):

- Para. 9: “Abatement in this case is required to continue until the 60th day after the date SureChoice receives statutorily compliant notice. Tex. Ins. Code

§542A.005(e). SureChoice has yet to receive such notice. Therefore, the Court may not compel mediation until this notice defect is cured and the abatement period is over.”

B.2.) Made the following FRIVOLOUS Legal Arguments for IMPROPER PURPOSES (to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3)):

- Para. 5: “Plaintiff’s Motion to Compel Mediation should be denied because this case was abated under Section 542A.005 of the Texas Insurance Code, and a court may not compel mediation in cases that are statutorily abated under §542A.005. See Tex. Ins. Code §542A.005(e).”

- Para. 6: “SureChoice’s Motion for Abatement alleged that Plaintiff failed to provide statutorily compliant notice under §542A.003 of the Texas Insurance code.6 Because SureChoice properly made this allegation, and verified its plea for abatement, this case was mandatorily and automatically abated under §542A.005 of the Texas Insurance Code…”

- Para. 6: Defendant wholly omitted that 542A.002(c)(2) expressly provides that abatement is not automatic where the plea in abatement is controverted by an affidavit filed by the claimant within eleven days (which occurred in this litigation).

- Para. 7: “Therefore, this case was automatically abated under

§542A.005(c)(1)(A).”

- Para. 8: “Because this case was automatically abated, Section 542A.005(f) of the Texas Insurance Code prohibits the enforcement of Plaintiff’s Motion to Compel Mediation.”

This Court finds that Defendant and its counsel made false statements of fact and frivolous legal arguments in its response to Plaintiff’s Motion to Compel Mediation. Again, Defendant misrepresented that it did not receive proper pre-suit notice. Supra. Moreover, Defendant’s counsel Monson Law Firm misrepresented law to this Court.

This Court finds that Monson Law Firm misrepresented that this case was already abated under Tex. Ins. Code §542A.005. It was not. First, Michael Cortez’s affidavit never averred to any defect in Plaintiff’s pre-suit notice, and therefore, abatement never could have been automatic. Second, out of an abundance of caution, Plaintiff filed a controverting affidavit under

§542A.005(c)(2), and therefore, abatement – at best – required a hearing, and was never automatic. Under no good faith reading of Defendant’s response could Defendant’s arguments have been construed as anything but frivolous and presented for improper purposes.

Likewise, Monson Law Firm insisted that this Court lacked authority to order mediation, despite obvious authority to the contrary, based solely on its own misrepresentation of law. On December 5, 2024, this Court sanctioned Defendant and its Counsel for violations of T.C.P.R.C. 10.001(1), (2), (3), and (4.) for its response to Plaintiff’s Motion to Compel Mediation and its previous November 4, 2024 filings. A total amount of $3,000.00 in monetary sanctions was ordered to be paid by Defendant to Plaintiff and Plaintiff’s Counsel. The Court also notes this sanction would be appropriately assessed under T.R.C.P. Rule 13, as Defendant’s response was groundless and brought in bad faith. This Court finds that to this date, this lesser sanction remains unpaid.

- On December 4, 2024, Defendant, by and through its counsel Monson Law Firm, misrepresented facts and law to this Court at a Hearing on Defendant’s and Plaintiff’s Motions. This Court denied Defendant’s Motions for Protection, for Abatement, for Fee Preclusion, and Granted Plaintiff’s Motion to Compel Mediation and Plaintiff’s Motion for Sanctions, Assessing $3,000.00 in Monetary Sanctions:

C.1.) Made the following FALSE Statements of Fact, presented for IMPROPER PURPOSES

(to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3), & (4)):

- Defendant, through counsel Monson Law Firm, misrepresented that Plaintiff never sent statutory pre-suit notice.

C.2.) Made the following FRIVOLOUS Legal Arguments for IMPROPER PURPOSES (to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3)):

- Defendant, through counsel Monson Law Firm, misrepresented that this Court had no legal authority to order mediation, by misrepresenting that this litigation was automatically abated.

The Court, after considering all briefing, evidence, and argument of counsel at that time assessed $3,000.00 in monetary sanctions against Defendant Surechoice Underwriters Reciprocal Exchange in a written order on December 5, 2024.

Since December 5, 2024, this Court finds that Defendant, by and through its counsel Monson Law Firm violated this Court’s December 5, 2024 orders, by:

- Defendant has not participated in discovery as ordered. Defendant has not completed initial disclosures, or responded to Plaintiff’s propounded discovery requests. These responses are overdue. This matter was never abated automatically or otherwise, and Defendant’s Motion for Abatement was unequivocally denied. This Court hereby determines any objections to Plaintiff’s propounded discovery requests are waived by operation of law. Defendant shall fully respond to Plaintiff’s discovery requests within 14 days of this order, or additional sanctions may be assessed.

- Defendant has not mediated as ordered. This Court ordered the parties to mediate, both on this Court’s own volition, and mandatorily under the Texas Insurance Code. Defendant has failed to mediate at ordered.

- Defendant has not paid monetary sanctions as ordered. This Court ordered Defendant to remit payment of monetary sanctions in the amount of $3,000.00. Defendant failed to do so.

- On December 13, 2024, Defendant, by and through its counsel Monson Law Firm, filed a Motion to Compel Appraisal, Misrepresenting Defendant’s Own Expressly Stated Position that “the appraisal section of the policy is reserved for disagreements in the financial amount of a covered loss, and not coverage disputes.” In this Motion, Defendant, by and through its Counsel, Monson Law Firm:

D.1.) Made the following FALSE Statements of Fact and FRIVOLOUS Legal Arguments, presented for IMPROPER PURPOSES (to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (2), (3), & (4)):

- Para. 10: “Even in a case where there is absolutely no coverage whatsoever, the contractual entitlement to have an amount of loss bound under the Policy’s terms via appraisal is clear under the law.”

- This is directly controverted by Defendant’s own statements to the contrary involving an identical policy.

This Court, at the December 4, 2024 hearing, and again on rehearing was presented evidence without objection from Karen Perez v. Surechoice Underwriters Reciprocal Exchange, pending before the County Court at Law No. 1 of Webb County, Texas.

In the Perez case, Defendant expressly opined on whether the Perez policy (which is identical to Plaintiff’s policy) allowed for appraisal where coverage was in dispute. Defendant unequivocally, in interpreting its own appraisal language stated: “the appraisal section of the policy is reserved for disagreements in the financial amount of a covered loss, and not coverage disputes.” In Perez, the Plaintiff invoked appraisal pre-suit before retaining counsel, and Defendant expressly rejected that appraisal demand, citing a coverage dispute. Here, Defendant likewise fully denied coverage, and now sought to compel appraisal upon being faced with a lawsuit that it had had notice was forthcoming for nearly a year.

This Court finds many bases outlined in Plaintiff’s response to Defendant’s motion to be meritorious, and therefore denied Defendant’s Motion to Compel Appraisal. For purposes of this order, however, this Court finds it a sanctionable misrepresentation of both fact and law to claim that appraisal is not available where coverage has been fully denied, as evidenced by Defendant’s own statements to the contrary in rejecting its policyholders’ appraisal demands made under identical policies. As addressed, infra., this Court finds that these arguments are part of a much more disturbing and systematic defensive strategy employed by Defendant and Monson Law Firm.

This Court also notes, that despite direct evidence to the contrary, in the Perez matter, Monson Law Firm’s Michael Cortez executed a false affidavit – under penalty of perjury – claiming “Plaintiff neither invoked nor completed appraisal presuit.” This verification was likewise attached to a verified Plea in Abatement by which Defendant, by and through Monson Law Firm, sought protection from discovery, abatement of litigation, and the Plaintiff to be precluded from recovering attorney’s fees. This disturbing pattern has been detected by this Court across hundreds of cases in which Defendant is sued by its policyholders and represented by Monson Law Firm.

- On December 13, 2024, Defendant, by and through its counsel Monson Law Firm, filed a Motion for Reconsideration of this Court’s December 5, 2024 Five Orders. In this Motion, Defendant, by and through its Counsel, Monson Law Firm:

E.1.) Made the following FALSE Statements of Fact, presented for IMPROPER PURPOSES

(to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3), & (4)):

- Para. 17: Lied that a Motion to Compel Discovery had been filed four months before this lawsuit was filed.

- Para. 18: Lied that a Hearing was conducted on a Motion to Compel Discovery and Motion for Summary Judgment over a month before this lawsuit was filed.

- Para. 19: Lied that a hearing took place months before Defendant had even appeared in this litigation.

E.2.) Made the following FRIVOLOUS Legal Arguments for IMPROPER PURPOSES (to Cause Delay and Increase Costs) (T.C.P.R.C. 10.001(1), (3)):

- Para. 29: Expressly misrepresented Supreme Court of Texas precedent, claiming the Supreme Court ruled the exact opposite of what it did on 542A.003’s “specific amount” requirements.

- Generally: Presented the same arguments with no new fact or law that this Court had already deemed sanctionable and denied.

In summary, this Court finds that Defendant’s Motion for Reconsideration presented absolutely no new facts and no new arguments. Indeed, in citing only a singular case (at the Court of Appeals, then again at the Supreme Court), Monson Law Firm expressly misrepresented the Supreme Court’s holdings as its sole basis for seeking reconsideration. This Court finds that Defendant’s Motion for Reconsideration is, in all things, sanctionable, as all issues presented therein were already considered by this Court on December 4, 2024.

- On January 22, 2025 a hearing took place on Defendant’s Motion for Reconsideration and Motion to Compel Appraisal. Defendant did not appear.

As stated, supra., Defendant failed to appear for the January 22, 2025 hearing. This Court held the matter until the end of the Court’s docket. Defendant did not appear, and the Court duly noted that no calls had been received regarding the basis for Defendant’s failure to appear. No

filings were presented before the Court in advance of the hearing regarding Defendant’s failure to appear. Indeed, a full week later, Defendant still did not file any notice with this Court.

With due consideration for all briefing to date, hearings, and evidence considered, the Court therefore DENIED Defendant’s Motions to Compel Appraisal and for Reconsideration. The Court also GRANTED Plaintiff’s Motion for Sanctions, in part, and otherwise denied same without prejudice. The Court awarded monetary sanctions assessed as follows:

(1.) Monson Law Firm shall remit payment of $5,000.00 payable to Ricardo Campos; and

(2.) Surechoice Underwriters Reciprocal Exchange shall remit payment of $5,000.00 payable to Ricardo Campos, in addition to the $3,000.00 sanction previously assessed on December 4, 2024.

Defendant shall remit these payments within fourteen days of this order, in addition to fully responding to all of Plaintiff’s propounded discovery. Proof of payment shall be filed with this court within fourteen days. Defendant shall attend a mediation within thirty days in good faith, and tender payment for the full mediation fee, due to its refusal to adhere to this Court’s prior order to do so.

Failure to comply with these orders shall leave this Court to consider assessing further, more severe sanctions, within its discretion. T.R.C.P. 215(b).

- This Court, in assessing sanctions described herein is mindful of Tex. Civ. Prac. & Rem. Code 10.4(b) which provides: “The sanction must be limited to what is sufficient to deter

repetition of the conduct or comparable conduct by others similarly situated.” (emphasis added).

- The Court, through briefing, argument of counsel, and evidence admitted has been made aware of disturbing trends throughout the State of Texas for litigation surrounding Defendant Surechoice Underwriters Reciprocal Exchange and Monson Law Firm. Upon review of docket sheet from over one-hundred litigated cases throughout the State, it is apparent that Defendant and Monson Law Firm’s sanctionable conduct described herein is rampant in virtually every single litigated claim dispute. This Court assesses, in part, the sanctions addressed herein to deter future similar conduct by Defendant and Monson Law Firm.

- A review of other courts’ dockets indicate that the strategy can summarily be outlined as follows:

(1.) Defendant upon rejecting pre-litigation notices, retains engineers to provide a basis for denying coverage for all claimed damages (after already accepting the losses as covered under the policy); upon being sued,

(2.) Defendant, vis-a-via a Monson Law Firm attorney’s sworn testimony, falsely claims any pre-suit notice was defective via a verified Plea in Abatement sworn to under penalty of perjury by Monson Law Firm attorneys,

(3.) Defendant, by and through Monson Law Firm, then uses this false sworn testimony to abate all proceedings and be protected from discovery,

(4.) While making frivolous legal arguments regarding abatement, Defendant, by and through Monson Law Firm, misrepresents that Courts have no authority to even order mediation, and simultaneously seeks to preclude its policyholders from recovering attorney’s fees, all by using 542A’s notice provisions and its own false sworn testimony as a weapon;

(5.) Defendant, by and through Monson Law Firm, then forces each claim – no matter how inappropriately – into appraisal (despite rejecting policyholders’ own demands for appraisal when coverage has been even partially denied under identical policies, claiming appraisal is unavailable where coverage is in dispute);

(6.) Defendant, by and through Monson Law Firm, then manipulates the appraisal process through the use of biased and unqualified appraisers (with one such Monson Law Firm appraiser’s disqualification being affirmed on appeal and petition denied by the Supreme Court, in In re Hromas); and upon execution of the appraisal award,

(7.) Defendant, by and through Monson Law Firm, dispute liability and refuse to pay the appraisal award, using the appraisal award as a “ceiling” to negotiate down from, all while Plaintiffs are precluded from recovery of attorney’s fees.

- Through this widespread and systematic gamesmanship, Defendant, by and through Monson Law Firm, effectively claims immunity from discovery and the judicial process as a whole. This Court notes under recent Supreme Court precedent, these abuses have become widespread, particularly with Defendant and Monson Law Firm, as evidenced by hundreds of docket sheets reviewed by this court from counties throughout the State of Texas. See Rodriguez

v. Safeco Ins. Co. of Indiana, 684 S.W.3d 789, 795 (Tex. 2024) (claiming abuse of its ruling by insurers would be purely speculative).

- This Court finds that abuse is happening, and is widespread.

- IT IS THEREFORE, ORDERED, ADJUDGED, AND DECREED: Plaintiff’s

Motion for Sanctions is GRANTED in part, as stated herein, and otherwise DENIED WITHOUT PREJUDICE.

SIGNED this day:

JUDGE PRESIDING

Copies:

Counsel for Plaintiff(s): Jason Palker, Raul De La Garza, Palker Law Firm, PLLC; Via Email: service@palkerlaw.com

Counsel for Defendant(s): Michael Cortez, The Monson Law Firm, LLC; Via email: Michael@monsonfirm.com

NUMBER 13-25-00095-CV COURT OF APPEALS

THIRTEENTH DISTRICT OF TEXAS

CORPUS CHRISTI – EDINBURG

IN RE THE MONSON LAW FIRM, LLC ON PETITION FOR WRIT OF MANDAMUS

OPINION

Before Chief Justice Tijerina and Justices West and Fonseca Opinion by Justice Fonseca1

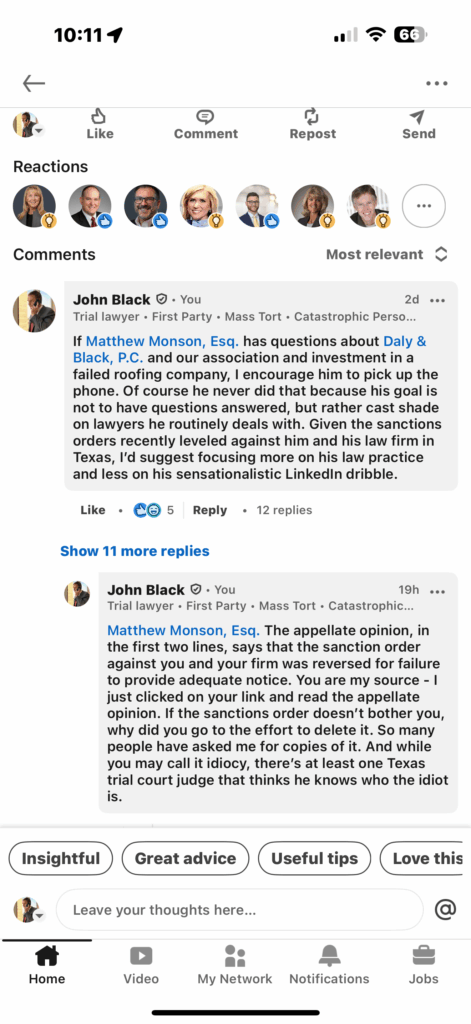

By petition for writ of mandamus, relator The Monson Law Firm, LLC2 (Monson) asserts that the trial court3 abused its discretion by issuing sanctions against it because,

1 See TEX. R. APP. P. 52.8(d) (“When denying relief, the court may hand down an opinion but is not required to do so. When granting relief, the court must hand down an opinion as in any other case.”); id. R.

47.4 (distinguishing opinions and memorandum opinions).

2 This original proceeding was originally brought in the name of SureChoice Underwriters Reciprocal Exchange (SureChoice); however, as will be discussed further in this memorandum opinion, the party seeking relief is The Monson Law Firm, LLC. We have corrected the style of this case accordingly. See id. R. 52.1, 52.2.

3 This petition for writ of mandamus arises from trial court cause number CL-24-3777-I in the County Court at Law No. 9 of Hidalgo County, Texas, and the respondent is the Honorable Patricia O’Caña- Olivarez. See id. R. 52.2.

inter alia, the sanction order was issued without notice and hearing. We agree, and accordingly, we conditionally grant the petition for writ of mandamus.

- Background

Real party in interest Ricardo Campos filed suit against SureChoice Reciprocal Underwriters Exchange (SureChoice) alleging that it wrongfully denied or underpaid Campos’s property damage claim resulting from a severe windstorm. Campos alleged that SureChoice engaged in unlawful underwriting and policy cancellations; violated the Texas Insurance Code by engaging in unfair settlement practices; failed to make prompt payment of his claims; committed fraud and conspiracy to commit fraud; breached its contract; breached the duty of good faith and fair dealing; and violated the Texas Deceptive Trade Practices Act. See, e.g., TEX. INS. CODE ANN. §§ 541.060(a) (unfair settlement practices), 542.055 (notice of claim), 542.058 (delay in payment of claim), 551.1055 (changes to policy on renewal); TEX. BUS. & COM. CODE ANN. § 17.46 (deceptive trade practices). Campos asserted that SureChoice’s claim-handling policies were designed to defraud its policyholders and that either SureChoice either failed to hire and train competent, qualified, and ethical adjusters, or it purposefully instructed its adjusters to ignore good faith claim handling practices and “to actively attempt to deny, underpay, underscope [sic], and minimize damages claimed by policyholders such as [Campos].” Campos alleged that SureChoice’s acts and omissions in this case, or similar acts and omissions, occur with such frequency that they constitute “a general business practice,” and that “[SureChoice’s] entire process is unfairly designed to reach favorable outcomes for the company at the expense of the policyholders.” Campos sought declaratory relief, actual and exemplary damages, and the award of attorney’s fees and costs. In a separate

pleading, Campos subsequently sought to compel statutory mediation of the case. See

TEX. INS. CODE ANN. § 541.161.

In response to Campos’s original petition and motion to compel mediation, SureChoice, represented by Monson, filed a “Combined Original Answer, General and Verified Denials, Affirmative Defenses, and Motions for Protection, Abatement, and Motion to Preclude [Attorney’s F]ees.” In short, SureChoice alleged that Campos failed to provide sufficient statutory notice of suit, and his claims should be submitted to appraisal pursuant to the insurance policy at issue. SureChoice argued that it should not be required to respond to discovery requests until these matters were resolved, and further asserted that the case should be abated pending their resolution. SureChoice also alleged that Campos was not entitled to recover attorney’s fees because he did not provide timely written notice before filing suit.

Campos filed a response to SureChoice’s motions for protection, abatement, and the preclusion of attorney’s fees, and that response included a motion for sanctions. Campos alleged that his presuit notice complied with all statutory requirements, argued that SureChoice’s motions were meritless and should be denied, and requested sanctions of $3,000 for the time that Campos’s counsel spent responding to SureChoice’s pleadings.

On December 4, 2024, the trial court held a hearing regarding Campos’s motion to compel mediation and SureChoice’s motions for protection, abatement, and the preclusion of attorney’s fees. On December 5, 2024, the trial court issued an order granting Campos’s motion to compel statutory mediation. That same day, the trial court also issued an order denying SureChoice’s motions for protection, abatement, and the

preclusion of attorney’s fees. This order also granted Campos’s motion for sanctions and ordered SureChoice to pay Campos $3,000.00. The trial court’s order recites merely that the $3,000 sanction “covers the time it took to research the applicable case law, review the file, prepare the initial responses to [SureChoice’s] meritless motions, and attend a hearing on these particular motions.”

On December 13, 2024, SureChoice filed a “Motion to Compel Appraisal, Policy Compliance[,] and Appraiser Appointment.” SureChoice also filed a separate motion seeking reconsideration of the trial court’s December 5, 2024 orders. On December 16, 2024, the trial court signed separate orders setting these two motions for hearing on January 22, 2025.

On January 17, 2025, Campos filed a response to SureChoice’s motion to compel appraisal and motion for reconsideration. This pleading included a second motion for sanctions. This response and motion spans eighty-five pages, and, in it, Campos requested sanctions against both SureChoice and Monson. Campos alleged that they failed to comply with discovery obligations, failed to participate in mediation or pay the previously assessed monetary sanction, made misrepresentations of law and fact, and displayed bad faith litigation tactics. Campos requested the trial court to sanction SureChoice and Monson each $12,500, payable to Campos and his counsel, and further requested the trial court to strike SureChoice’s pleadings.

On January 21, 2025, SureChoice filed a motion seeking reconsideration of the trial court’s rulings denying its motions for protection, abatement, and the preclusion of attorney’s fees, requiring mediation, and imposing sanctions against SureChoice. That same day, SureChoice also filed a reply in support of its motion to compel appraisal,

policy compliance, and appraiser appointment. And it further filed a reply in support of its request for reconsideration of the $3,000 sanction imposed against it.

On January 22, 2022, the trial court held its hearing on SureChoice’s motions to compel appraisal, policy compliance, and appraiser appointment and motion for reconsideration. As will be discussed further, neither Monson nor any representative of SureChoice appeared at the hearing. Nevertheless, the trial court proceeded with the hearing, and it allowed Campos’s counsel to present evidence and argument regarding his second motion for sanctions, even though it had not been set for hearing at that time.

On February 3, 2025, the trial court signed an order granting in part and denying in part Campos’s second motion for sanctions. The trial court’s second sanction order imposed an additional $5,000 sanction against SureChoice, in addition to the $3,000 sanction previously imposed, and further imposed a separate $5,000 sanction against Monson. The trial court directed Monson and SureChoice to make these payments to Campos within fourteen days. The trial court otherwise denied Campos’s second motion for sanctions without prejudice.

The eleven-page sanction order is detailed and concludes that SureChoice “by and through its counsel [Monson]” made misstatements of fact and frivolous legal arguments for the purposes of causing unnecessary delay, harassing Campos, and needlessly increasing the cost of litigation. This order references Texas Civil Practice and Remedies Code § 10.001 and Texas Rule of Civil Procedure 13. See TEX. CIV. PRAC. & REM. CODE ANN. § 10.001–.006 (governing sanctions for frivolous pleadings and motions); TEX. R. CIV. P. 13 (providing sanctions for groundless pleadings and motions).

The trial court’s order states that SureChoice, acting by and through Monson, had not participated in discovery, mediated, or paid the monetary sanctions as previously ordered on December 5, 2024.4 The order also states that, since that time, SureChoice “by and through its counsel” had made additional misstatements of fact and frivolous legal arguments. For instance, the trial court concluded that Monson “expressly misrepresented” the Texas Supreme Court’s holdings in seeking reconsideration of the trial court’s rulings. The trial court’s order also notes that SureChoice failed to appear at the January 22, 2025 hearing and failed to notify the court before or afterward of any rationale for its nonappearance. The trial court concluded that SureChoice and Monson had taken inconsistent positions regarding appraisal in different cases as a “disturbing and systematic defensive strategy.” In making this determination, the trial court examined a separate case and determined that an attorney from Monson had executed a false affidavit therein. The court also reviewed “docket sheets from over one[ ]hundred litigated cases throughout the State” and concluded that SureChoice and Monson had engaged in sanctionable conduct that was “rampant and widespread.” Accordingly, it assessed sanctions, in part, “to deter future similar conduct.”

This original proceeding ensued. By petition for writ of mandamus, Monson asserts that the trial court abused its discretion by issuing the sanction order for failing to appear at a hearing because it “advised [the court] of [its] inability to appear in-person,” “sought remote appearance beforehand,” Campos’s counsel “was aware of [its] inability” to

4 We note that the trial court further, inter alia, determined that SureChoice had waived its objections to all of Campos’s discovery requests by failing to participate in discovery as ordered. The trial court ordered SureChoice to “fully respond” to all such discovery requests within fourteen days.

appear in person, and “no notice of hearing on sanctions/order to show cause [was] issued in violation of [the] right to due process.”

This Court requested and received a response to the petition for writ of mandamus from Campos. See TEX. R. APP. P. 52.2, 52.4, 52.8. Campos asserts that: (1) Monson’s appendix should be struck because it contains evidence that was not presented to the trial court; (2) the issue presented here is moot due to settlement; (3) the trial court did not abuse its discretion; (4) the sanction is not reviewable by mandamus because Monson has an adequate remedy by appeal; and (5) alternatively, this Court should order Monson to file a proper appendix and record before further addressing its contentions. Monson filed a reply to Campos’s response.

- Mandamus

Mandamus relief is an extraordinary remedy available only on a showing that

(1) the trial court clearly abused its discretion and (2) the party seeking relief lacks an adequate remedy on appeal. In re Ill. Nat’l Ins., 685 S.W.3d 826, 834 (Tex. 2024) (orig. proceeding); In re Liberty Cnty. Mut. Ins., 679 S.W.3d 170, 174 (Tex. 2023) (orig. proceeding) (per curiam). “A court abuses its discretion if no evidence supports the finding on which its ruling rests and if the court could reasonably have reached only a contrary conclusion.” In re AutoZoners, LLC, 694 S.W.3d 219, 223 (Tex. 2024) (orig. proceeding) (per curiam). We conduct a “benefits-and-detriments analysis” to determine if the relator possesses an adequate remedy at law. In re Auburn Creek Ltd. P’ship, 655 S.W.3d 837, 843 (Tex. 2022) (orig. proceeding) (per curiam); see In re Prudential Ins. Co. of Am., 148 S.W.3d 124, 136–37 (Tex. 2004) (orig. proceeding).

- Mootness

Campos asserts that this original proceeding has been rendered moot because the parties reached a settlement agreement which encompasses the matters at issue in Monson’s petition for writ of mandamus. Campos alleges that the parties filed a “Joint Notice of Settlement” (Joint Notice) in the underlying lawsuit which encompasses the sanctions against Monson. Campos thus contends that “this entire mandamus proceeding is a complete waste of judicial resources.”

By reply, Monson asserts that its petition for writ of mandamus is not moot because the Joint Notice did not encompass the sanction rendered against it. The Joint Notice states that Campos and SureChoice “have resolved all their disputes and a settlement has been reached in this matter” and provides that the settlement will be finalized within a set period. The Joint Notice does not reference Monson, and it was filed on behalf of SureChoice by different counsel, Thompson Coe Cousins & Irons, LLP (Thompson Coe). On March 13, 2025, we issued an order requesting Thompson Coe to clarify this matter. On March 20, 2025, Thompson Coe advised this Court that: (1) SureChoice did not intend to be a party to this original proceeding; (2) the proposed settlement encompasses the release of both SureChoice and Monson from liability for any damages claimed by Campos in the underlying lawsuit; (3) the settlement encompasses the sanctions ordered against SureChoice; and (4) the settlement does not encompass the

sanctions ordered against Monson.

Based upon the foregoing, we conclude that the mandamus is not moot as to Monson, and we proceed accordingly.

- Record and Appendix

Campos presents various complaints regarding the record for Monson’s petition for writ of mandamus and has filed a motion to strike Monson’s appendix.

- The Record

As a liminal matter, Campos asserts that if we “deem it necessary for this matter to proceed any further,” we should order Monson to present an appellate record in compliance with Texas Rule of Appellate Procedure 34. See generally TEX. R. APP. P.

34.1–.6. Campos’s assertion is premised on a fundamental misapprehension regarding the Texas Rules of Appellate Procedure. Rule 34 governs the “appellate record” and is applicable to appeals. See id. The record for a petition for writ of mandamus is not subject to the rules pertaining to appeals but is instead governed by the appellate rule concerning original proceedings. See generally TEX. R. APP. P. 52; see id. R. 52.7 (delineating the contents of the record); id. R. 52.3(k) (describing the necessary contents for the appendix). Rule 34 is inapplicable to Monson’s petition for writ of mandamus, and we reject Campos’s assertion otherwise.5

Campos also contends that Monson’s record fails to include all required documents—for example, it fails to include the exhibits that were admitted at the January 22, 2025 hearing. Campos asserts that this deficiency mandates the denial of Monson’s request for relief. Campos is correct that the relator bears the burden to provide the Court with a sufficient record to establish its right to relief. Walker v. Packer, 827 S.W.2d 833, 837 (Tex. 1992) (orig. proceeding); In re J.A.L., 645 S.W.3d 922, 924 (Tex. App.—El Paso

5 We note that Monson filed a conjoined record and appendix whereas the rules contemplate separate filings. See TEX. R. APP. P. 52.3(k), 52.7. Nevertheless, in our discretion, we consider Monson’s petition sufficient under the specific circumstances present here. See id. R. 2.

2022, orig. proceeding); In re Schreck, 642 S.W.3d 925, 927 (Tex. App.—Amarillo 2022, orig. proceeding). However, the items required for a record filed in an original proceeding are limited to what is “material” to the “claim for relief” and what is “relevant” to the “matter complained” about in the petition for writ of mandamus. See TEX. R. APP. P. 52.7(a)(1),

(2). Thus, the required contents for a record vary from case-to-case. See id. R. 52.7(a); see also In re S.M., No. 13-23-00371-CV, 2023 WL 6475319, at *4 (Tex. App.—Corpus Christi–Edinburg Oct. 4, 2023, orig. proceeding) (mem. op.).

Here, Monson’s complaint is not that the trial court issued the wrong ruling based on an assessment of the evidence presented. See, e.g., In re Athans, 458 S.W.3d 675, 678 (Tex. App.—Houston [14th Dist.] 2015, orig. proceeding) (stating that “relators must provide this court with a mandamus record of all of the trial evidence before this court may determine whether the respondent abused his discretion in concluding that the trial evidence is factually insufficient”). Rather, Monson’s contention, in relevant part, is that the trial court held a hearing on Campos’s second motion to compel sanctions without providing notice or an opportunity to be heard. Monson’s record and appendix contain the documents material and relevant to this issue. Accordingly, we do not deny mandamus relief based on any alleged insufficiency in the record.

- Motion to Strike

Campos’s response to the petition for writ of mandamus includes a motion to strike Monson’s appendix because it contains materials that were not presented to the trial court. Campos has moved to strike Monson’s entire appendix, or in the alternative, “at an absolute minimum,” certain specified portions of the appendix.

In original proceedings, we “must focus on the record that was before the court” when it made its decision. In re Bristol-Myers Squibb Co., 975 S.W.2d 601, 605 (Tex. 1998) (orig. proceeding); see Sabine OffShore Serv., Inc. v. City of Port Arthur, 595 S.W.2d 840, 841 (Tex. 1979) (orig. proceeding) (per curiam); In re Liberty Cnty. Mut. Ins., 606 S.W.3d 866, 874 (Tex. App.—Houston [14th Dist.] 2020, orig. proceeding [mand. denied]). With limited exceptions, we do not consider documents or exhibits that were not part of the trial court record at the time the court heard and ruled on the matter that is the subject of the mandamus proceeding. See In re Liberty Cnty. Mut. Ins., 606 S.W.3d at 874; In re State ex rel. Durden, 587 S.W.3d 78, 81 (Tex. App.—San Antonio 2019, orig. proceeding).

Monson’s appendix largely consists of file-stamped pleadings that were patently considered by the trial court as directly relevant to the issues here: to wit, the motions and responses concerning sanctions. Campos provides no reason to strike these documents. Accordingly, we deny Campos’s motion to strike as it applies to Monson’s entire appendix. We next consider Campos’s alternative request to strike three specific sections of Monson’s appendix. First, Campos has moved to strike the exhibits attached to SureChoice’s original answer and motions, including Campos’s insurance policy and correspondence pertaining to his claim. Second, Campos has moved to strike email correspondence regarding Monson’s inability to appear at the hearing on January 22, 2025, and his requests to reset the hearing. On January 20, 2025, at 10:30 a.m., Monson sent an email to Campos’s counsel and the Hidalgo County District Clerk’s office with the subject “URGENT: Inclement Weather—cannot attend in-person hearing CAUSE NO.

CL-24-3777-I Richard Campos v. SureChoice Underwriters,” advising that:

Due to the polar vortex bringing dangerous weather conditions to my area, and the state, my flight was cancelled.

I attempted to contact the Court, today, to see how it would be handling the inclement weather conditions, but the Court was closed due to the MLK holiday, and I was unable to contact.

Since I will not be able to attend the hearing in person due to circumstances beyond my control, I am requesting a courtesy link so that I can attend the hearing remotely. I am attorney for Defendant SureChoice Underwriters.

This is regarding the hearing at 10:30AM on January 22, 2025.

That afternoon, Campos’s counsel replied to Monson’s email, but the reply did not include the Hidalgo County District Clerk’s office as an addressee. Campos’s counsel told Monson that “[i]t’s not that long a drive and other options are still available” and suggested that Monson travel by bus. The morning of January 22, 2025, at 8:51, Monson emailed Campos’s counsel:

Could you extend a professional courtesy to me—similar to the professional courtesy I extended to you by signing your Rule 11 agreement to pass a hearing in Webb County when Raul was on vacation last.

This hearing is scheduled for 10:30AM today and I cannot get there due to circumstances beyond my control. The airports here will not be starting to depart flights until 11AM today and everything was shut down yesterday due to the weather. Even Greyhound wouldn’t have got me there before 2pm today—with 14 hours travel time billed at $200 [an] hour.

Third, Campos has moved to strike email correspondence regarding rescheduling the hearing after it occurred. On Thursday, January 23, 2025, Monson advised the Hidalgo County District Clerk’s office by email that: “Yesterday (January 22nd), we were unable to appear at a hearing due to flight cancellations / delays and weather conditions. We would like to ask to reschedule the hearing please. Can you assist us with that?” In response, the district clerk’s office advised Monson to “contact the court directly regarding your inquiry,” and provided a link to do so.

We need not consider these portions of Monson’s appendix to address the merits of this petition for writ of mandamus.6 Therefore, we dismiss Campos’s motion to strike these items as moot.

- Summary

We reject Campos’s contentions regarding alleged insufficiencies in Monson’s mandamus record. We likewise reject Campos’s arguments pertaining to Monson’s appendix. Campos’s motion to strike the appendix is denied in part and dismissed as moot in part.

- Sanctions

By one issue, Monson asserts that the trial court abused its discretion by issuing sanctions, inter alia, in the absence of notice and hearing in violation of its due process rights. In response, Campos asserts that the sanctions were appropriate and supported by the evidence, and further argues that Monson’s absence from the January 22, 2025 hearing was “unjustified” and “unexcused,” and the evidence submitted to the trial court regarding the sanctions was uncontroverted.

- Standard of Review

We review a sanction order under an abuse of discretion standard. Brewer v. Lennox Hearth Prods., LLC, 601 S.W.3d 704, 717 (Tex. 2020); Nath v. Tex. Child.’s

6 We are not surprised that Campos’s counsel has moved to strike certain portions of Monson’s appendix insofar as they appear, in part, to reflect conduct, comments, and behavior that are inconsistent with an attorney’s professional obligations. “[A]busive tactics—ranging from hostility to obstructionism—do not serve the justice we pursue.” PNS Stores, Inc. v. Rivera, 379 S.W.3d 267, 276 (Tex. 2012) (citing and discussing The Texas Lawyer’s Creed—A Mandate for Professionalism (1989), https://www.txcourts.gov/media/276685/texaslawyerscreed.pdf (last visited Apr. 25, 2025). “[T]he conduct of lawyers ‘should be characterized at all times by honesty, candor, and fairness,’” and “an attorney ‘will not take advantage, by causing any default or dismissal to be rendered, when [he] know[s] the identity of an opposing counsel, without first inquiring about that counsel’s intention to proceed.’” Id. (quoting The Texas Lawyers Creed). Although not at issue or relevant to the matter before us, we cannot ignore the fact that counsel’s actions and tactics are disconcerting.

Hosp., 446 S.W.3d 355, 361 (Tex. 2014). We limit our review of the sanctions order to the specific rules cited in the order. Am. Flood Rsch., Inc. v. Jones, 192 S.W.3d 581, 583– 84 (Tex. 2006) (per curiam); Tarrant Restoration v. TX Arlington Oaks Apartments, Ltd., 225 S.W.3d 721, 732 (Tex. App.—Dallas 2007, pet. dism’d w.o.j.); Metzger v. Sebek, 892 S.W.2d 20, 51 (Tex. App.—Houston [1st Dist.] 1994, writ denied). Here, the sanction order references Chapter 10 of the Texas Civil Practice and Remedies Code and Texas Rule of Civil Procedure 13. See generally TEX. CIV. PRAC. & REM. CODE ANN. §§ 10.001–

.004; TEX. R. CIV. P. 13.

- Presumptions and Burden of Proof

We presume pleadings and other papers are filed in good faith. Nath, 446 S.W.3d at 361; GTE Commc’ns Sys. Corp. v. Tanner, 856 S.W.2d 725, 731 (Tex.1993) (orig. proceeding); In re Guardianship of Browning, 642 S.W.3d 598, 607 (Tex. App.—Eastland 2022, pet. denied); KB Home Lone Star Inc. v. Gordon, 629 S.W.3d 649, 658 (Tex. App.— San Antonio 2021, no pet.). The party seeking sanctions bears the burden of overcoming this presumption of good faith. Nath, 446 S.W.3d at 361; GTE Commc’ns Sys. Corp., 856 S.W.2d at 731; In re Guardianship of Browning, 642 S.W.3d at 607; KB Home Lone Star Inc., 629 S.W.3d at 658. “Demonstrating a party filed a motion or pleading in bad faith is a heavy burden.” Wenger v. Flinn, 648 S.W.3d 448, 456 (Tex. App.—San Antonio 2021, no pet.); see Mann v. Kendall Home Builders Constr. Partners I, Ltd., 464 S.W.3d 84, 92 (Tex. App.—Houston [14th Dist.] 2015, no pet.). “Bad faith does not exist when a party merely exercises bad judgment or is negligent; rather[,] bad faith is the conscious doing of a wrong for dishonest, discriminatory, or malicious purposes.” Thielemann v. Kethan, 371 S.W.3d 286, 294 (Tex. App.—Houston [1st Dist.] 2012, pet. denied). In this regard,

bad faith cannot be established by surmise or speculation. Mann, 464 S.W.3d at 92. Thus, to enable the trial court to make the necessary factual determinations about motives and credibility, the trial court is required to hold an evidentiary hearing. Orbison v. Ma-Tex Rope Co., 553 S.W.3d 17, 35 (Tex. App.—Texarkana 2018, pet. denied); WWW.URBAN.INC. v. Drummond, 508 S.W.3d 657, 677 (Tex. App.—Houston [1st Dist.] 2016, no pet.).

- Due Process

“[I]n order to safeguard constitutional due process rights, a sanction must be neither unjust nor excessive.” Nath, 446 S.W.3d at 363.7 Further, “[t]he traditional due process protections of notice and hearing are required before sanctions may be imposed.” Mills v. Ghilain, 68 S.W.3d 141, 146 (Tex. App.—Corpus Christi–Edinburg 2001, no pet.); see In re Bennett, 960 S.W.2d 35, 40 (Tex. 1997) (orig. proceeding) (per curiam); Clark

v. Bres, 217 S.W.3d 501, 513 (Tex. App.—Houston [14th Dist.] 2006, pet. denied); In re Acceptance Ins., 33 S.W.3d 443, 451 (Tex. App.—Fort Worth 2000, no pet.); In re L.A.M. & Assocs., 975 S.W.2d 80, 83 (Tex. App.—San Antonio 1998, orig. proceeding). In this regard, both Chapter 10 and Rule 13 expressly require notice and hearing prior to the imposition of sanctions. See TEX. CIV. PRAC. & REM. CODE ANN. § 10.003 (“The court shall

77 To determine if a sanction is just, we apply a two-part test. Schindler Elevator Corp. v. Ceasar, 670 S.W.3d 577, 589 (Tex. 2023); TransAm. Nat. Gas Corp. v. Powell, 811 S.W.2d 913, 916 (Tex. 1991)

(orig. proceeding). First, we must ensure that there is a direct relationship between the improper conduct and the sanction imposed. Schindler, 670 S.W.3d at 589; TransAm. Nat. Gas Corp., 811 S.W.2d at 917. Because the sanction should be directed toward the true offender, the trial court must attempt to determine whether sanctions should be imposed on the party, its attorney, or both. Schindler, 670 S.W.3d at 589; TransAm. Nat. Gas Corp., 811 S.W.2d at 917. Second, the sanction must not be excessive. Schindler, 670 S.W.3d at 589; TransAm. Nat. Gas Corp., 811 S.W.2d at 917. The sanction “should be no more severe than necessary to satisfy its legitimate purposes.” TransAm. Nat. Gas Corp., 811 S.W.2d at 917. These due process requirements apply to pleadings sanctions. Nath v. Tex. Child.’s Hosp., 446 S.W.3d 355, 364 (Tex. 2014).

provide a party who is the subject of a motion for sanctions under Section 10.002 notice of the allegations and a reasonable opportunity to respond to the allegations.”); TEX. R. CIV. P. 13 (“If a pleading, motion or other paper is signed in violation of this rule, the court, upon motion or upon its own initiative, after notice and hearing, shall impose an appropriate sanction ”). Relatedly, “[w]hen sanctions are based on a party’s motion,

a trial court may not award sanctions on grounds not asserted in that motion.” Reynolds Energy Transp., LLC v. Plains Mktg., L.P., 706 S.W.3d 845, 875 (Tex. App.—San Antonio 2024, no pet.); see Polansky v. Berenji, 393 S.W.3d 362, 369 (Tex. App.—Austin 2012, no pet.); Mann, 464 S.W.3d at 93.

- Analysis

On December 16, 2024, the trial court signed an order setting “an oral hearing for [SureChoice’s] Motions to Compel Appraisal, Policy Compliance and Appraiser Appointment” to be held on January 22, 2025, at 10:30 a.m. That same day, the trial court signed a second order setting “an oral hearing for [SureChoice’s] Motions to Reconsider” to be held on that same date at that time.

On January 17, 2025, Campos filed a response to SureChoice’s motion to compel appraisal and motion for reconsideration. This response included Campos’s second motion for sanctions, which, for the first time, requested sanctions against Monson specifically. However, nothing in the record before this Court indicates that Campos’s second motion for sanctions was set to be heard on January 22, 2025. Nevertheless, the trial court allowed Campos to present his second motion for sanctions for consideration at that time, and the trial court then granted that motion in relevant part. The imposition of sanctions based on Campos’s second motion for sanctions in the absence of notice

and an opportunity to be heard violated Monson’s right to due process and the express terms of the Texas Civil Practice and Remedies Code and the Texas Rules of Civil Procedure requiring notice and hearing before imposing sanctions. See In re Bennett, 960 S.W.2d at 40; Clark, 217 S.W.3d at 513; Mills, 68 S.W.3d at 146; In re Acceptance Ins., 33 S.W.3d at 451; In re L.A.M. & Assocs., 975 S.W.2d at 83; see also TEX. CIV. PRAC. & REM. CODE ANN. § 10.003; TEX. R. CIV. P. 13.

- Conclusion

We conclude that the trial court abused its discretion by sanctioning Monson without notice and an opportunity to be heard in violation of the law and in violation of Monson’s due process rights. See TEX. CIV. PRAC. & REM. CODE ANN. § 10.003; TEX. R. CIV. P. 13; In re Bennett, 960 S.W.2d at 40; Clark, 217 S.W.3d at 513; Mills, 68 S.W.3d at 146; In re Acceptance Ins., 33 S.W.3d at 451; In re L.A.M. & Assocs., 975 S.W.2d at

83. Having reached this conclusion, we need not address any additional deficiencies in the trial court’s order.

- Remedy by Appeal

Monson asserts that it, as a non-party, has no adequate remedy on appeal to address the sanction order, making mandamus the appropriate relief. Alternatively, Monson asserts that the payment of monetary sanctions must be deferred until the rendition of an appealable judgment. Campos asserts, in contrast, that mandamus relief is inappropriate because Monson has an adequate remedy by appeal. In this regard, Campos specifically contends that Monson has not shown that the monetary sanction at issue precludes access to the court.

Orders imposing monetary sanctions can “typically” be addressed by appeal following a final judgment. In re Casey, 589 S.W.3d 850, 855 (Tex. 2019) (orig. proceeding) (per curiam). However, when a trial court imposes a monetary sanction payable before the rendition of an appealable order, mandamus relief may be available if the sanctioned litigant “contends that a monetary sanction award precludes access to the court,” and the trial court fails to either (1) make the sanction payable on or after entry of a final order, or (2) make express written findings, after a hearing, as to why the sanction does not have such a preclusive effect. Id.; Braden v. Downey, 811 S.W.2d 922, 929 (Tex. 1991) (orig. proceeding). This procedure helps ensure an adequate remedy for an improper sanctions order is available by appeal. In re Casey, 589 S.W.3d at 851; Braden, 811 S.W.2d at 930. In such cases, we may direct the trial court to modify the sanctions order to defer payment until final judgment is rendered, allowing the opportunity to appeal before such sanctions must be paid. See In re Casey, 589 S.W.3d at 851; Braden, 811 S.W.2d at 930.

In this case, the trial court’s order requires payment within fourteen days, and Monson did not explicitly contend in the trial court that the order precluded its access to the court. However, we remain mindful that the adequacy of a remedy by appeal “depends heavily on the circumstances presented and is better guided by general principles than by simple rules.” In re Prudential Ins. Co. of Am., 148 S.W.3d at 137. We do not apply “abstract,” “formulaic,” or “rigid” standards. Id. at 136. Thus, while we could order the trial court to defer payment of the sanction until after the rendition of a final judgment, we find under the circumstances of this case that it would not provide a complete remedy to Monson.

With limited exceptions, only parties of record have standing to appeal a trial court’s judgment. State v. Naylor, 466 S.W.3d 783, 787 (Tex. 2015); Medlin v. King, 705 S.W.3d 267, 283 (Tex. App.—El Paso 2024, pet. denied); Moody v. Herz, Tr. of Three R Trusts, 672 S.W.3d 842, 846 (Tex. App.—Houston [14th Dist.] 2023, no pet.). When a non-party has no right to appeal, mandamus is appropriate. In re United Healthcare Ins., 652 S.W.3d 458, 461 (Tex. App.—San Antonio 2022, orig. proceeding); In re Berry, 578 S.W.3d 173, 182 (Tex. App.—Corpus Christi–Edinburg 2019, orig. proceeding); In re Bain, 144 S.W.3d 236, 239 (Tex. App.—Tyler 2004, orig. proceeding); City of Hous. v. Chambers, 899 S.W.2d 306, 308 (Tex. App.—Houston [14th Dist.] 1995, orig. proceeding).

A party’s attorney, although a nonparty, may appeal sanctions imposed against that attorney once a final judgment is rendered in the case. In re Onstad, 20 S.W.3d 731, 732 (Tex. App.—Texarkana 2000, orig. proceeding [mand. denied]); see also In re Beard, No. 12-15-00005-CV, 2015 WL 273187, at *1 (Tex. App.—Tyler Jan. 20, 2015, orig.

proceeding) (mem. op.); In re Union Pac. R.R. Co., No. 12-08-00497-CV, 2009 WL 4167809, at *2 (Tex. App.—Tyler Nov. 25, 2009, orig. proceeding [mand. denied]) (mem. op.). But see In re Hill, No. 02–07–00295–CV, 2007 WL 2891059, at *1 (Tex. App.—Fort Worth Oct. 3, 2007, orig. proceeding) (mem. op.) (concluding that an attorney who previously represented a party could not “bring an appeal to complain about the imposition of sanctions” rendered against that attorney). However, Monson is no longer representing SureChoice in this litigation. Campos and SureChoice have resolved their claims by settlement. Our record fails to reflect if a final judgment has already been rendered or when it might be rendered in the future. If a final judgment has already been

entered, Monson may have already lost the right to pursue a direct appeal. If it has not, Monson may not receive notice of that judgment in time to pursue an appeal. Review by mandamus in these circumstances preserves Monson’s substantive right to challenge an order issued in violation of its due process rights. See In re Prudential Ins. Co. of Am., 148 S.W.3d at 136. Moreover, if Monson is required to pay Campos the sanction now and then wait until after a final judgment to appeal, it may not be able to recover the sanction from Campos at that future juncture. See id. Further, Monson would incur additional expense in pursuing an appeal and such an appeal would be a waste of judicial resources. See id. 136–37 (granting mandamus review when trial court’s order would have wasted public and judicial resources, lacked legal authority, and would have negatively impacted the legal system). Finally, we consider the circumstances of this case to be extraordinary for the reasons set forth above. See id.

Under these circumstances, we conclude that Monson lacks an adequate remedy by appeal to assail the sanctions assessed against it.

- Conclusion

The Court, having examined and fully considered the petition for writ of mandamus, Campos’s response, Monson’s reply, and record, is of the opinion that Monson has met its burden to obtain mandamus relief. Accordingly, we lift the stay that we previously imposed in this original proceeding. See TEX. R. APP. P. 52.10 (“Unless vacated or modified, an order granting temporary relief is effective until the case is finally decided.”). We conditionally grant the petition for writ of mandamus, and we direct the trial court to vacate its February 3, 2025 sanction order. We are confident the trial court will promptly

comply, and our writ will issue only if the trial court fails to act in accordance with this opinion.

YSMAEL FONSECA

Justice

Delivered and filed on the 30th day of April, 2025.